Timber and Joinery Products Sales up 2.6% year-on-year in July

Timber and Joinery Products Sales up 2.6% year-on-year in July

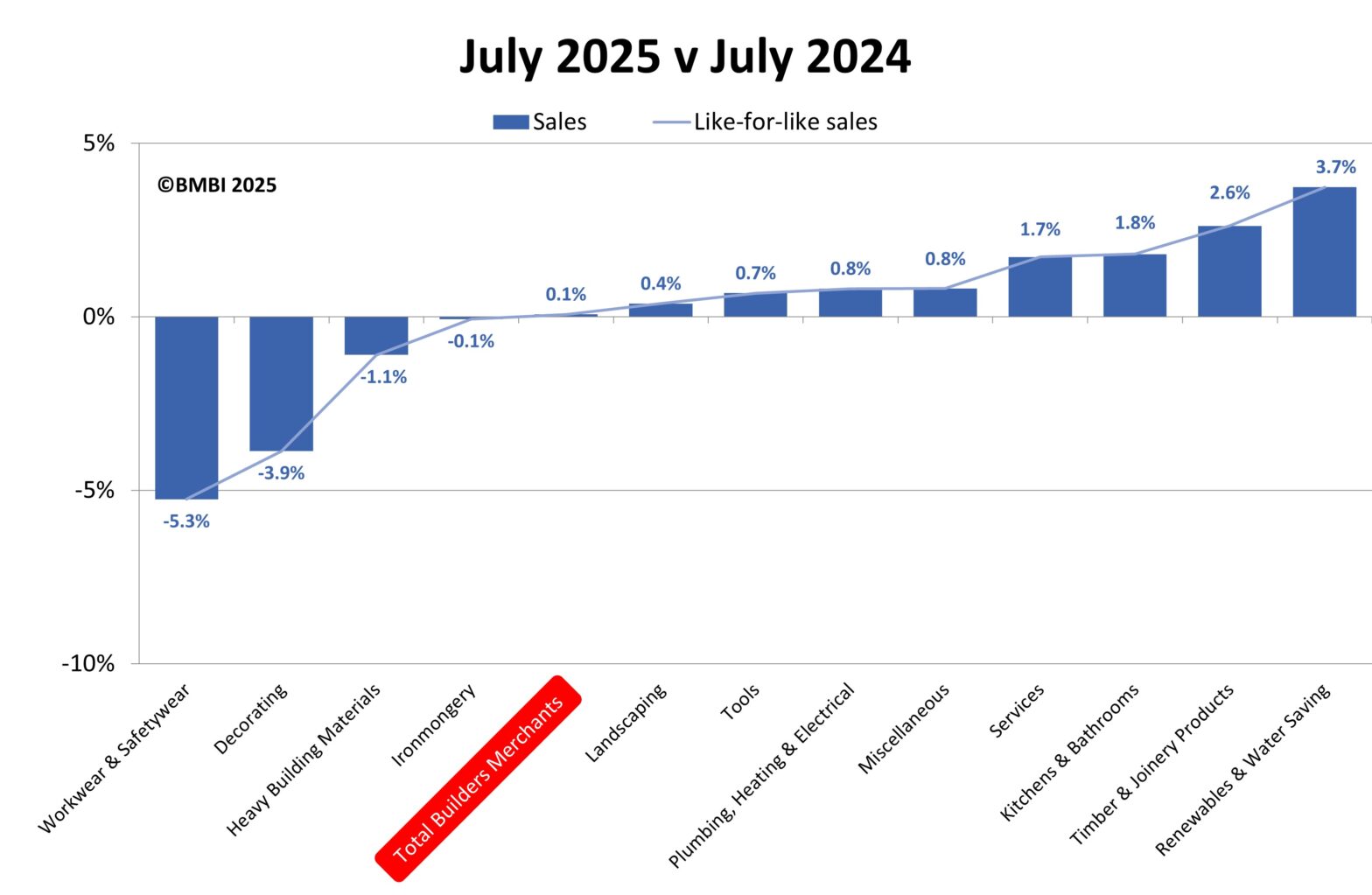

The latest figures from the Builders Merchants Building Index (BMBI), published in September, show total value sales in July 2025 were virtually flat (+0.1%) compared to July 2024. Year-on-year volumes increased +0.6% while prices fell -0.6%, despite there being no difference in trading days.

Eight of the twelve categories sold more in terms of value compared to July last year. Timber & Joinery Products (+2.6%) was among the best performing categories, alongside Renewables & Water Saving (+3.7%), Kitchens & Bathrooms (+1.8%) and Services (+1.7%). Heavy Building Materials (-1.1%), Decorating (-3.9%) and Workwear & Safetywear (-5.3%) were the weakest.

Value sales in July were +5.8% higher than in June. Month-on-month, volume sales were up +5.4% and prices were up +0.4%. All categories’ value sales increased with Timber & Joinery Products (+6.9%) one of the stronger categories. Miscellaneous (+11.3%), Services (+9.0%), Tools (+8.9%), Decorating (+7.4%), Heavy Building Materials (+6.3%) and Ironmongery (+6.0%) also did better than most. With two extra trading days in July, like-for-like value sales (which take trading day differences into account) were -3.4% lower.

In the three months from May to July 2025, total value sales were +1.8% higher than the same three-month period a year before. Volume sales were up +3.0% while prices were down -1.2%. Ten categories sold more in terms of value with Renewables & Water Saving (+13.3%), Timber & Joinery Products (+4.0%), Plumbing, Heating & Electrical (+3.9%) and Services (+2.8%) leading the field.

Total value sales in the 12 months from August 2024 – July 2025 were flat (0.0%) compared to the previous 12-month period (August 2023 – July 2024). Volume sales increased +1.7% but prices decreased -1.7%. Seven categories sold more by value. Of the two biggest categories, Heavy Building Materials’ (0.0%) performance was on a par with Total Builders Merchants, while Timber & Joinery Products (-1.1%) fell behind. With one less trading day this year, like-for-like value sales were +0.4% higher.

For the latest reports, Expert comments and Round Table Debates, visit www.bmbi.co.uk.

More news

TJN’s Lignum Timber Casement sets new testing benchmark

GGF seeks government clarity on Warm Homes Plan opportunities